A new era for inbound tax payers and researchers

As from January 1, 2022, a new tax regime for inbound taxpayers and researchers entered into force. A more simplified and transparent new system provide more legal certainty to employers and qualifying employees/directors. The new regime is incorporated in the Income Tax Code, providing a stronger legal basis than a Circular Letter where standard tax residency rules will apply.

For many years long Belgium has offered an attractive special tax regime for foreign executives and specialist temporarily employed in Belgium. Internationals (expats) benefit from:

- Non-taxable allowances

- Foreign travel exclusion

- Deemed non-residency for income tax purposes

With the new tax regime some procedural aspects changed and are eligible for inbound taxpayers, who meet the following conditions:

- Either assigned to Belgium by a foreign affiliate of the group or directly hired abroad

- No connection to Belgium in a 60 month period

- Not have been considered as a tax resident

- Not have been taxed as a non-resident on professional income

- Not have lived closer than 150km from Belgian border

- For inbound tax payers (employee and company director status)

- Minimum gross package of EUR 75.000 required

- For researchers (employee status)

- Master degree or at least 10 years of experience in R&D (based on CV)

- ≥ 80% of the employee’s professional activities should be related to R&D

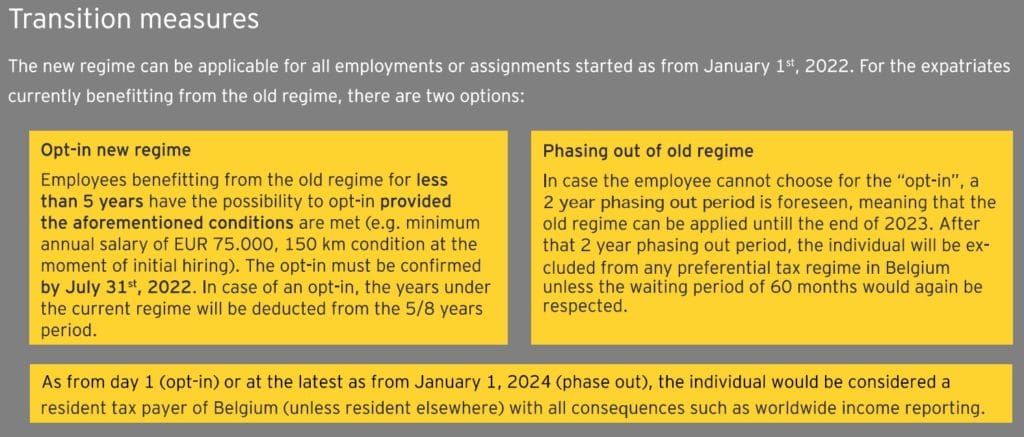

The new regime will be applicable for all employments or assignments starting as of January 1st, 2022. In order to benefit from the new system well-defined steps are to be followed, annual follow-up actions are required:

- Application by employer (with employee’s consent) within 3 months following the start of the employee

- Authorities will send back a confirmation within 3 months

- Employers will have to provide tax authorities on an annual basis before January 31, X+1 with a listing of all qualifying employees for the preceding year (authorities will link the information with the fiche 281.10/20)

- When meeting all qualifying requirements, a re-application is possible when changing employer in Belgium

Important remark: for employees currently benefitting from the special tax regime (or without regime thus far), these conditions shoud be verified as from the start date of their Belgian employment and on January 1,2022. In case these conditions are not met, the employee can not opt for the new regime. But a grandfathering period of two years is foreseen (income year 2022 and income year 2023) for the employees who can not choose to ‘opt-in’ in the new regime.

Benefits

The benefits of the new special tax regime are different from the old regime, which was introduced in 1983:

- Recurring expenses up to 30% on top of the gross remuneration can be considered as a cost proper to the employer

- Based on lump sum evaluation

- Should be explicitly included in the employment contract

- Capped at EUR 90.000 (Pro rata in case no full employment in Belgium)

- Following expenses are considered as a tax-free reimbursement of employer’s business expenses (not included in the 30% ceiling)

- Moving costs

- Furnishing costs (up to EUR 1.500)

- School fees as from the age of 5

Conclusion

With the proposed initiative the government will put an end to a tax regime that has existed for almost four decades. As with any change this represents both challenges and opportunities. In the short term a number of questions still needs to be answered and might lead to a period of relative uncertainty. In the longer run, the new tax regime will result in a more simplified and transparent system providing more legal certainty to companies and their international workforce.

It is equally clear that the new regime is significantly more restrictive in terms of access to the regime and duration of the benefits. For high income earners the benefits are capped, but for a significant other section of executives the new regime could be more beneficial.

More info or guidance in this new tax regime?

Please contact us and we will introduce you to a partner from our expert network. They have a settled roadmap to guide companies though this change process.

Source:

- https://www.ey.com/en_be/tax/tax-alerts/a-new-tax-regime-for-inbound-taxpayers-and-researchers

- https://www.ey.com/en_be/tax/tax-alerts/2022/a-new-era-for-inbound-tax-payers-and-researchers?utm_campaign=56d5b02173a6a35d8504cbb4&utm_content=61dd785365601c00019e248c&utm_medium=smarpshare&utm_source=linkedin